Our core business lies in real estate with development potential. We manage the renovation, revitalisation or redevelopment of suitable buildings, optimise these properties, and make them attractive for the rental market. We focus on locations in metropolitan areas and growth regions.

We are portfolio developers and redevelopers. Our core business is the strategic purchasing of properties with development potential – properties that can be upgraded in the short-to-medium term through redevelopment or revitalisation and then managed in our portfolio. We recognise the need to make a long-term commitment to the location in order to generate the long-lasting, sustainable yields we desire.

For more than 60 years, we have been offering cost-effective rental space to small and medium-sized companies in particular with consistently stable, competitive conditions. As a long-term portfolio holder, we take a service-focused approach to our work with our tenants and pride ourselves on being a reliable partner. We invest in properties with a variety of usage types – apartments, offices, hotels, logistics, commercial spaces and parking garages – in Germany, elsewhere in Europe, and the United States.

This investment structure gives us a broad base with considerable stability. Since individual real estate sectors often develop in cyclical phases, submarkets currently experiencing a peak can compensate for volatility in other areas. This doesn’t just boost our stability. Our sectoral diversification also enormously increases the medium- and long-term earning power of our overall portfolio.

Reliability and trustworthiness are core values within our corporate culture. These are based not just on strict compliance with legal and contractual regulations, but also a fundamental understanding of what constitutes ethical behaviour. This includes openness, fairness, and tolerance, along with conservation of resources, gender equality, and the promotion of diversity, and providing clear guidelines and assistance to help people manage risks and possible conflict.

Agility and dynamism

Our organisation is defined by flat hierarchies, flexible structures, and entrepreneurial spirit.

Real estate expertise

The Terrania Group has an enormous wealth of real estate expertise, covering considerable breadth and detail.

Stable balance sheet

We have a strong and consistently stable balance sheet – our partners can rest easy knowing we will continue to be a trustworthy business partner in the future.

Fully integrated business model

We offer fully integrated solutions, all available from a single expert provider.

Strong market knowledge

We are well connected both nationally and internationally and are familiar with the quirks and features of individual markets.

We have also developed our strategy and expertise. Our traditional investments in portfolio and revitalisation properties have been supplemented by investments in development projects – in response to the lower returns in many established markets. This combination enables us to maintain our high earning power even under changed market conditions.

We take responsibility for our properties and invest in their quality in a sustainable way – going above the industry standard. On average, more than 20 per cent of our total rental income is reinvested into the expansion and refurbishment of our properties.

The economic viability and sustainability of a given property are always our central focus. However, there can come a point at which reinvestment will no longer reap the same rewards, as the cost of the refurbishment or revitalisation work would equal the cost of a new building. In such cases, the result of the cost-benefit analysis isn’t satisfactory, so we turn to developing our own projects instead.

Integrated solutions: We cover the entire value-added cycle through our own in-house team. Because trust is built on continuity. We only manage and let properties that we own. This eliminates commission fees, which benefits tenants, because businesses in particular need affordable space. We always offer our tenants the maximum possible flexibility and provide a dedicated contact on site – because good service adds value for our tenants.

Asset management: The purchase and sale of residential and commercial properties, along with the valuation, optimisation, and analysis of our portfolio, are some of the key activities we engage in to sustainably increase returns and value in the medium-to-long term.

Property management: Holistic, life-cycle-focused and sustainable property management is indispensable in ensuring the long-term, optimal use of our properties. This especially includes the administration, letting, and marketing of the properties.

Facility management: Professional maintenance management of our properties is vital for full compliance with all health and safety standards.

Construction and project management: Regular renovation and expansions are a top priority, which guarantees and improves the quality of our portfolio over the longer term.

Investment management: Investment means progress and growth. This makes it all the more important to invest in development properties alongside the traditional investments in existing buildings and revitalisation projects.

On-site rental offices: Rental offices are present at each of our locations to provide service-based partnership for our tenants. This ensures smooth property management and reliable tenant support.

We have built a broadly diversified portfolio over recent decades. Our various sectors include offices and commercial spaces, hotels, retail and logistics, residential, and parking.

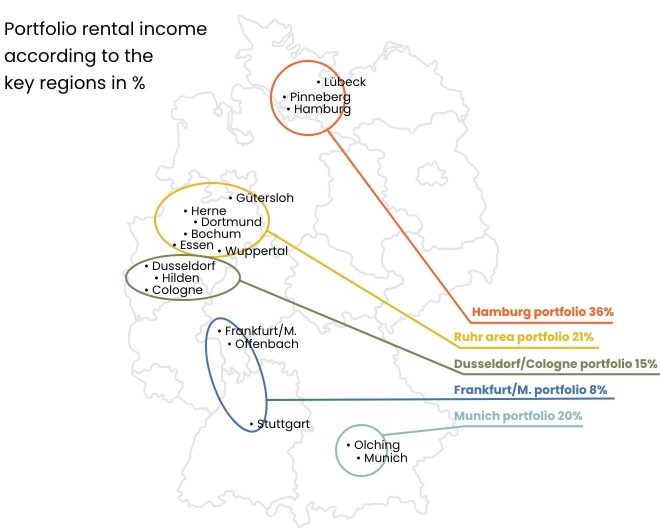

Our portfolio strategy focuses on acquiring and managing attractive commercial properties in metropolitan and growing regions that are characterised by steady inward migration, growing household numbers, and increasing economic parameters, alongside insufficient construction activities to meet that demand.

As a sustainable portfolio manager with a long-term approach and deep expertise in commercial properties, we exclusively manage our portfolios ourselves. In developing the portfolio, we are not interested in scattergun growth. Instead, we focus on geographically coherent portfolios of sufficient minimum size in our core regions. This allows us to exploit economies of scale and manage properties efficiently and cost-effectively.

Our focus is definitively on management-intensive commercial properties. However, we also acquire everything from opportunistic properties to core properties across various asset classes. Our spectrum includes hotels, multi-storey car parks, industrial sites and logistics, residential, corporate real estate, and retail. Individual properties that do not meet these criteria are accepted as part of a portfolio if the majority of the properties do meet our criteria.

Opportunistic and value-added investments are the focus, but we are also interested more generally in core investments. Minimum tenant terms play a less significant role in our business, because we invest in substance, not contracts.

Our shareholders and our tenants place more importance on professionalism, trust, quick decision-making, personal contact, flexibility, and continuity. Our unique focus lays the foundation for our work: we do not make money from transactions, but from renting and leasing. That is why we commit for the long term. This is what brings stable and attractive returns for our shareholders.

When a society changes, real estate must also adapt to meet its changing needs. That’s why it’s our ambition to develop properties that retain their value and span generations – properties that will continue to impress in the future. Our goal is to generate stable and attractive returns for our shareholders over the long term. To achieve this, we invest in properties with different usage types – from apartments and offices to parking garages – in Germany, elsewhere in Europe, and the United States. This risk diversification strategy makes us independent of individual markets and ensures the stable development of the company.

Stability through broad sectoral diversification

We have built up a portfolio that is broadly diversified by sector, with its main segments being offices, retail, logistics, residential, and parking garages. The chosen structure increases the stability of the earnings and performance of the real estate portfolio, because the cyclical trends are usually not synchronised across sectors. This allows submarkets that are currently performing especially well to compensate for weak periods in other submarkets. This doesn’t just boost our stability. Our sectoral diversification also considerably increases the medium- and long-term earning power of our overall portfolio.

Focus on active management of our property portfolio

The lifecycle of a property comprises many stages, which we consider as a whole. As experienced asset managers, we plan, manage, and implement targeted measures designed to add value, while keeping the entire property portfolio in mind. The aim is always to increase value and optimise returns. Our investors can build on this secure foundation.

We deal with offices, commercial buildings, apartments, and retail properties every day. For us, these are not just properties, but prospects for success, growth, and value creation.

Companies depend on being able to find and use suitable spaces for their business activities. We specialise in the acquisition, repositioning and management of corporate real estate, light industrial, and retail properties in major German cities. We provide strategic and operational asset management, due diligence, investment, letting, tenant development planning, and property and facility management services – comprehensive, integrated services from our in-house experts. This structure gives us expertise in the value of each property’s substance and location, especially regarding investment. We then realise this value via long-term repositioning through active and small-scale work on the property.

Real estate isn’t the only thing we focus on. We’re also about people, concepts, and vision. Collaboration with long-term partners, access to valuable resources, and our growing expertise play a big role in our success. Our task is to combine all the individual parts in such a way that makes great things possible.

Since our founding, we have focused on financial independence. It allows us to act independently and quickly, and to remain flexible. And we invest in our most important asset: our employees. The dedication and experience of our highly skilled team have enabled us to successfully realise projects of all dimensions for more than 50 years. And our values, not just commercial value, have always been at the forefront. We foster a culture defined by integrity, reliability, innovation, results-focus, and sustainability – and that rewards excellence.

By distributing our property investments as broadly as possible across different usage types, including apartments, offices, hotels, logistics, retail, and parking garages, we even out the risks of variable market performance. This is a strong risk diversification strategy, which provides much greater security for investors.

In our portfolio, we generate continuous cash flows from rental income with long-term stability. We also optimise the value of our portfolio properties through active and forward-looking letting management work, and realise profits through individual sell-offs. For us, stability is about avoiding cluster risks, both in terms of the asset classes and the tenant structure across the different locations. The development work we do is not just about quantitative improvements, but also qualitative. We enact these measures based on the assets we anticipate will be in demand over the short and longer term.

Our properties are located throughout Germany and beyond, and we manage and develop these from our offices in Munich, Frankfurt, Hamburg, Dusseldorf, and Dortmund. You are invited to visit us in person.